The State of APAC’s Alt Protein Industry in 10 Charts

Written by GFI APAC Corporate Engagement Manager Jennifer Morton, Innovation Associate Valerie Pang, and Research Associate Divya Gandhi.

Note: APAC as referred to in this post covers the countries/regions of Australia/New Zealand, Mainland China, Hong Kong SAR, Indonesia, Japan, Malaysia, the Philippines, Singapore, South Korea, Taiwan, Thailand, and Vietnam.

May we have your attention, please!

GFI APAC’s first-ever State of the Industry Report was just published, and it tells a fascinating story about how APAC’s alternative protein sector is evolving.

The full report is available for free to download, but here are some of the big-picture takeaways:

The topline numbers

As the world’s most populous region, a hotbed of technological innovation, and an engine of global manufacturing, Asia Pacific is a critical part of accelerating alternative proteins. But only in the past few years have we seen that engine really start to rev.

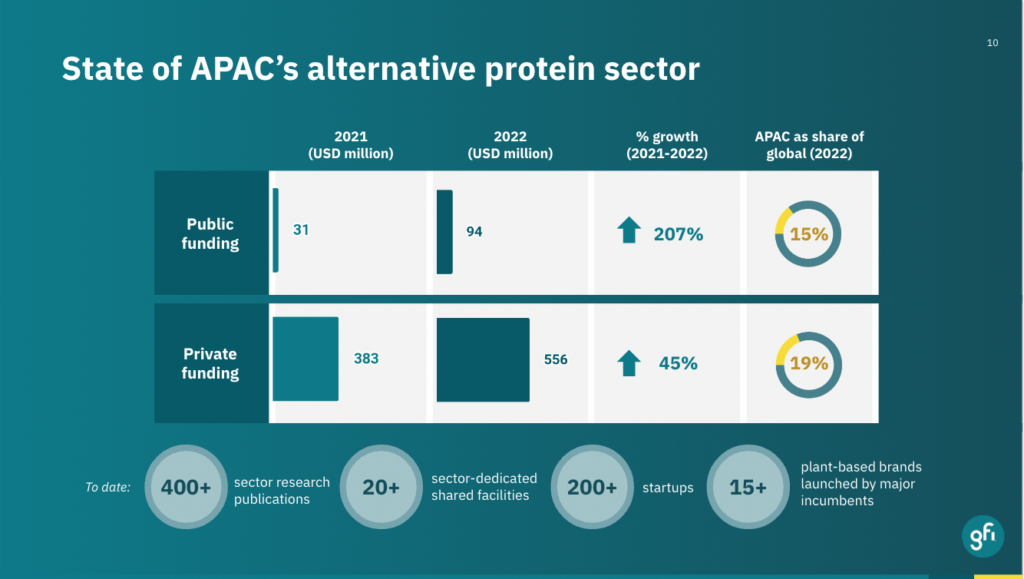

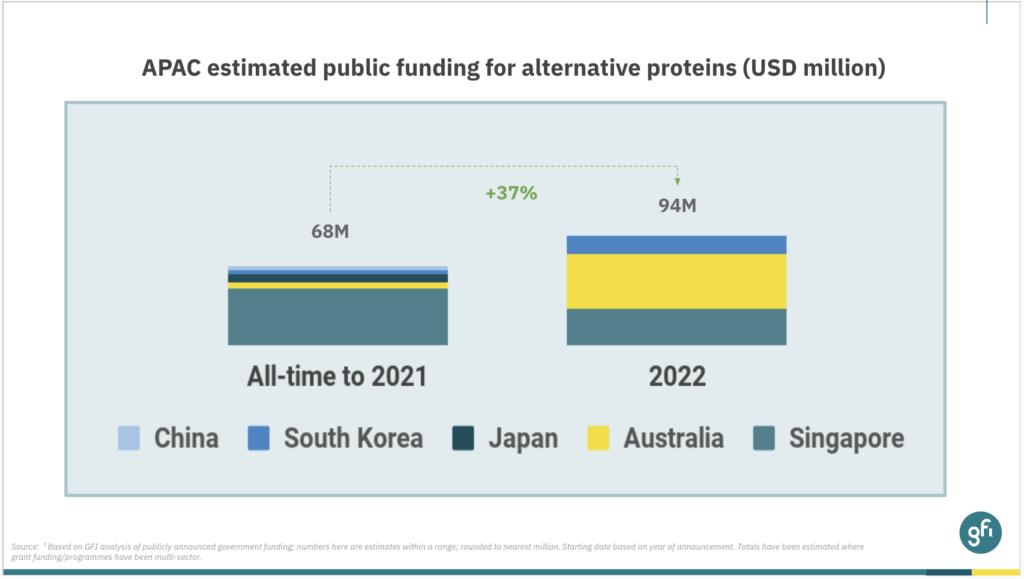

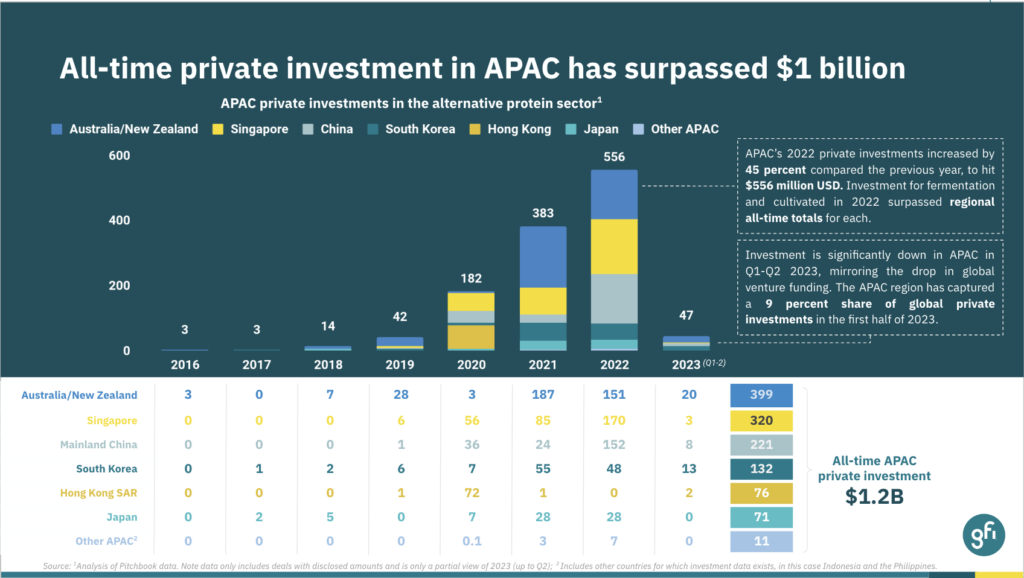

Public funding for alternative proteins in APAC increased by 207 percent year-over-year between 2021 and 2022, from $31 million to $94 million (USD). Private funding also increased by 45 percent from $383 million to $556 million in the same period.

To put those stats in historical context, APAC’s public investment figure in 2022 was 37 percent higher than the all-time total up to 2021. In a global context, APAC’s public investments account for 16 percent of all public funding to date.

On the private investment side, more than $1 billion (USD) has now been invested in APAC’s alternative protein sector. Private investments climbed by 45 percent year-over-year to reach $556 million (USD) investment in 2022.

But the investment landscape changed significantly as 2023 got underway, as a broader downturn in macroeconomic conditions brought global venture funding for all sectors to a 13-quarter low. This downturn has heavily affected alternative proteins too, with a sharp decline in private funding levels as of Q2 2023, though we also see from an investor survey that the majority of active investors in APAC see the long-term potential of alternative proteins and plan to continue making investments.

A fast-growing R&D and business ecosystem

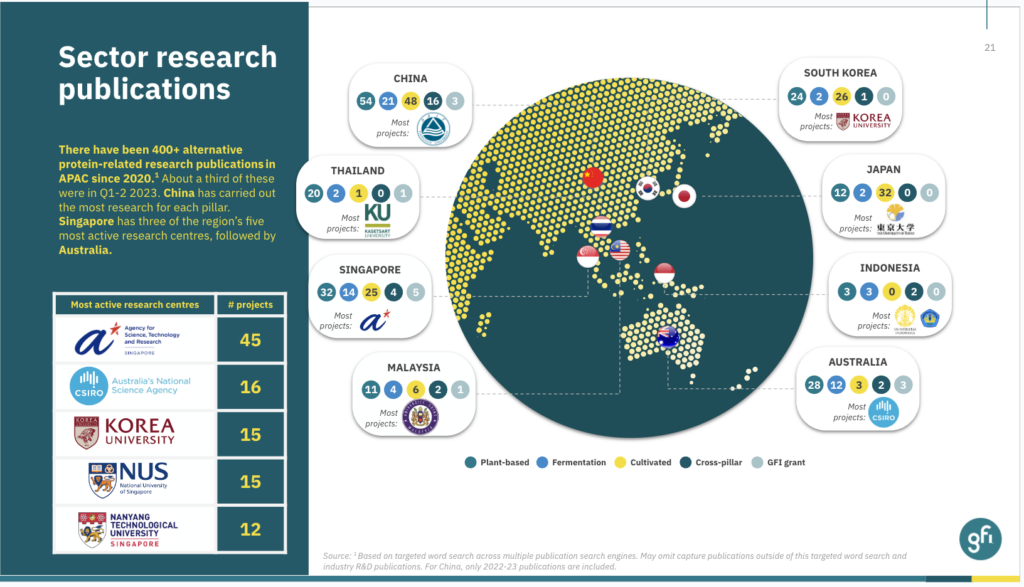

Our research shows that APAC scientists have become an increasingly important source of technical knowledge and R&D progress in recent years. Researchers have released more than 400 alt protein-related publications in APAC in just the past three years. China, Singapore, and South Korea are the countries with the highest output of research publications, with Singapore’s Agency for Science, Technology and Research (A*STAR) emerging as the region’s most prolific alt protein research centre by a significant margin.

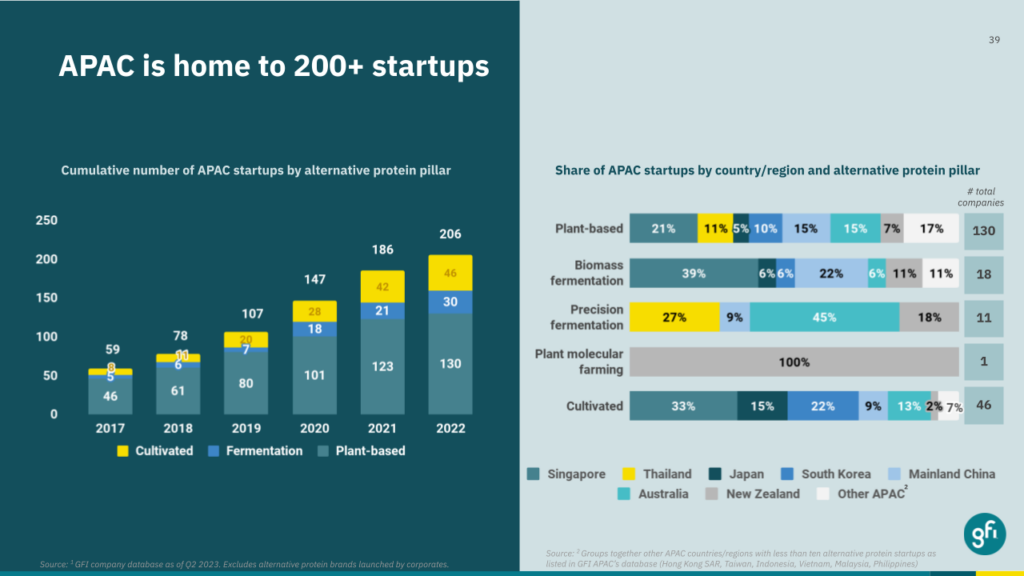

APAC also has a thriving and increasingly diverse business ecosystem. The region is home to more than 200 startups, including 20 that launched in 2022. Notably, in an inversion from previous years, most of the APAC alt protein startups launched in 2022 were focused on B2B solutions, rather than B2C sales.

Major APAC-based meat companies, food conglomerates, and biotechnology companies have further bolstered this growth by participating in over 20 investments and partnerships with startups. Corporate-startup partnerships are now underway for end-product development as well as B2B solutions, particularly cell-culture media development.

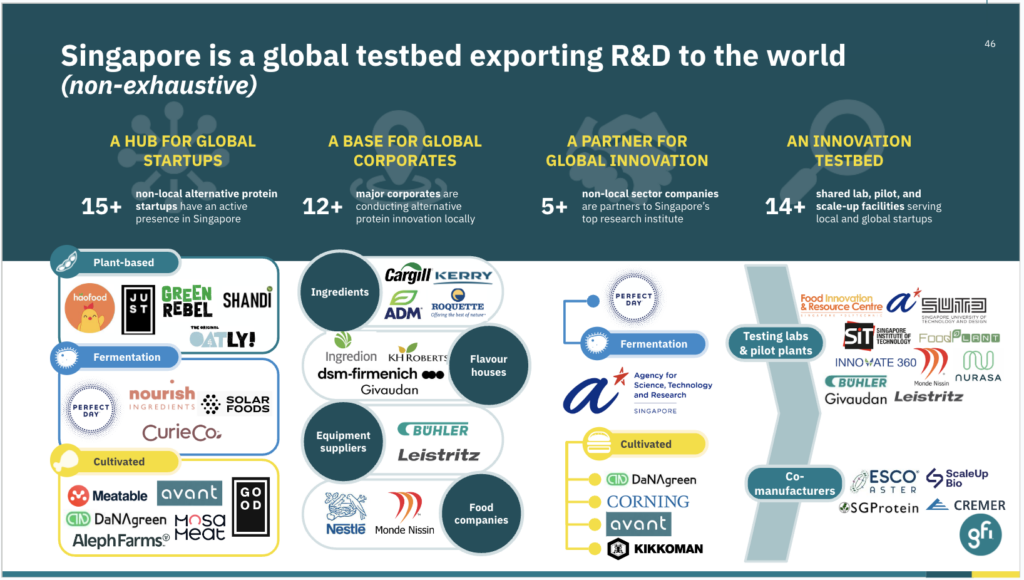

Singapore, in particular, has proven to be a regional launchpad, helping global companies incubate, innovate, partner, and export their alternative protein solutions around the world. 24 percent of APAC alternative protein startups are based in Singapore, and at least 25 non-local startups and corporates have set up shop in the Lion City to conduct alt protein R&D and develop their business. Shared R&D facilities and a supportive regulatory framework are further enabling companies to bring their products from lab-scale through to market testing.

The biggest challenges to overcome

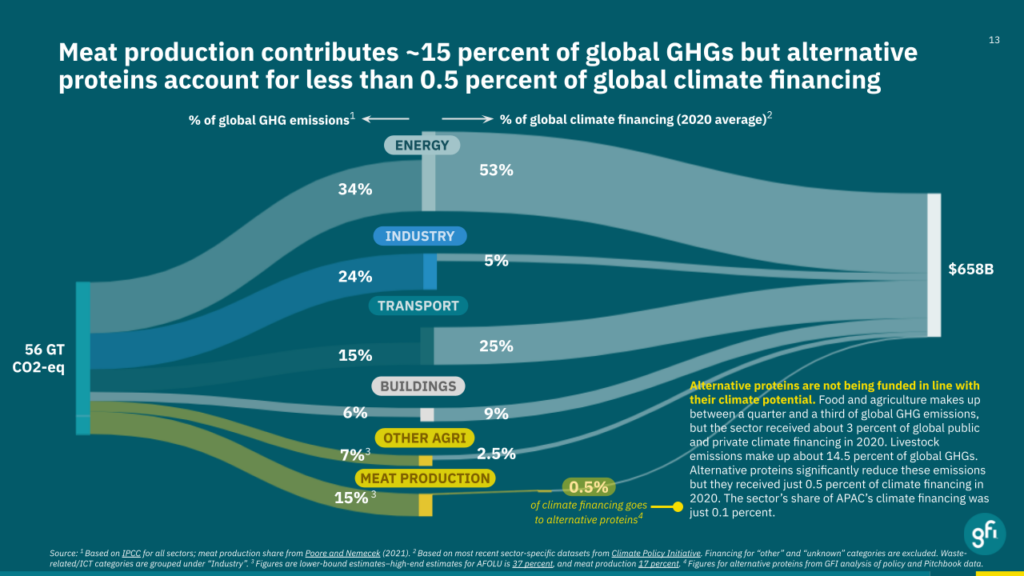

Despite recent progress in APAC, public funding for alternative proteins remains far below the level needed for the sector to reach its full potential. Meat production contributes roughly 15 percent of global greenhouse gas emissions (GHGs), but based on 2020 figures, food and agriculture only accounts for about three percent of total global public and private climate financing, with alternative proteins representing a 0.5 percent share.

This stark contrast means the food system is leaving massive potential climate savings on the table. Research shows that if funding were to enable alternative proteins to capture even eight percent of the global meat market by 2030, that shift would reduce GHGs by as much as decarbonising 95 percent of the aviation sector. Unlocking the full benefits of alternative proteins will require an estimated $10.1 billion (USD) in global public funding per year.

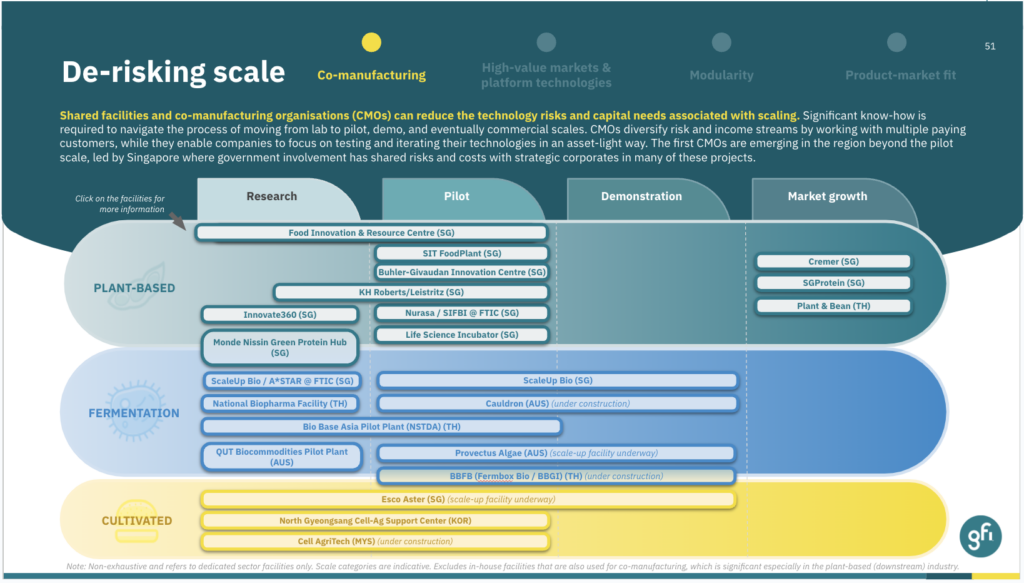

Similarly, there is an urgent need to address the alt protein industry’s scale-up challenges. Building factories cheaply and proving demand in early markets will help to make scale-up more affordable, easier to finance, and lower risk. Co-manufacturing organisations (CMOs) at various scales can further support efficient sector scaling.

Singapore has laid the foundations of a CMO network to de-risk early scale-up. First-movers are also exploring the scaling advantages of other APAC countries for later-stage co-manufacturing, and looking for additional ways to de-risk alternative protein scale-up, including modular scale-out, platform technologies, higher-value markets, and targeted value propositions, to strengthen market adoption. But as shown in the chart below, significant gaps remain in APAC’s scaling capacity—with considerably more facilities needed at various scales across the different alt protein technologies, especially demonstration, first-of-a-kind, and commercially-proven facilities built to share and built for scale.

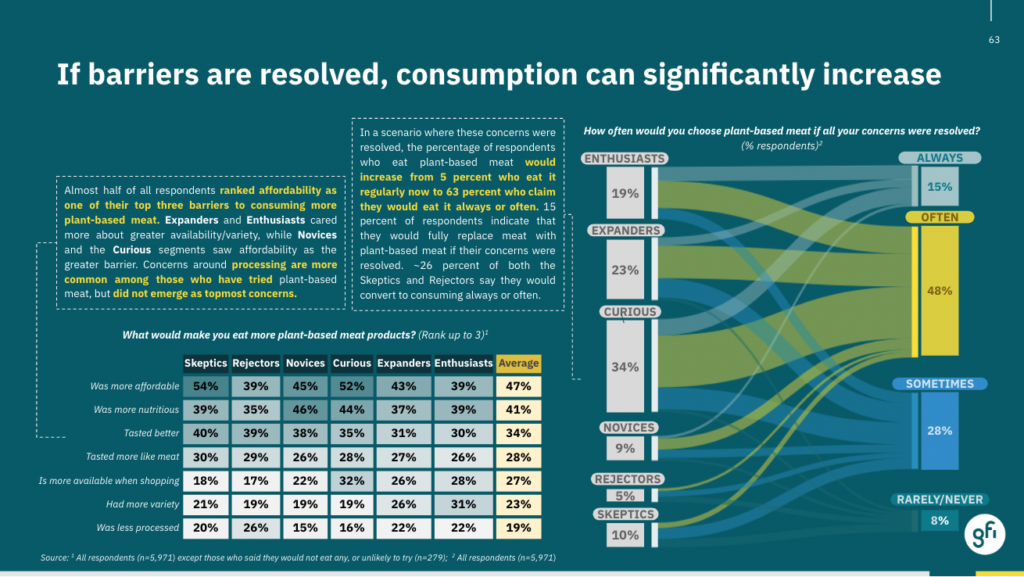

The final piece in the APAC alt protein puzzle is consumer demand. To better understand local consumer perceptions, GFI APAC partnered with Good Growth on a six-month study of consumer perceptions related to plant-based meat. We surveyed nearly 6,000 respondents from six Southeast Asian countries: Indonesia, Malaysia, the Philippines, Singapore, Thailand, and Vietnam. Based on the data gathered, respondents were categorised into six different segments based on their experiences and intended consumption of plant-based meat.

The survey showed that the top three barriers to respondents consuming more plant-based meat were affordability, nutrition, and taste. In a scenario where these concerns were resolved, the percentage of respondents who would eat plant-based meat increased from five percent to 63 percent. 15 percent of respondents indicated they would fully replace conventional meat with plant-based meat if such concerns were resolved.

Additionally, in a finding that may come as a surprise to some industry followers, respondents classified as Enthusiasts—those who are most enthusiastic about the alt protein sector—also consume animal meat the most often, and intend to continue doing so, while alt protein Skeptics and Novices consume meat the least.

In other words, in Southeast Asia, Enthusiasts are more likely to want to eat more of all kinds of meat, whether made from plants or animals.

Perhaps it should be no surprise then that 93 percent of all survey respondents reported at least some interest in trying a ‘blended’ product that mixed conventional and plant-based meat, with over half stating they were very interested. Notably, almost two-thirds of alt protein Rejectors and Skeptics expressed some interest in blended products, with almost a fifth of Rejectors describing themselves as very interested. Enthusiasts were the most interested, which reiterates the conclusion that Enthusiasts are generally looking for more protein diversity, rather than meat replacements.

The road ahead

With only six years remaining for the world to cut its emissions in half to avert the most severe consequences of climate change, APAC doesn’t have a moment to waste. Research shows that expanding the production of alternative proteins is one of the most effective strategies we possess to mitigate the significant environmental impacts of the food industry.

To harness this opportunity, the sector must secure billions of dollars in additional R&D funding to stimulate product innovation and allocate hundreds of billions for the expansion of new technologies. While short-term fluctuations can be found in the sector when closely examined, stakeholders would be wise to also focus on the long-term necessity, sustained progress, and the enduring potential of alternative proteins.

Just as in other climate mitigation categories, the path forward involves discerning which solutions are viable and which are not, enabling us to concentrate our efforts on a portfolio of technologies to expedite their scaling by 2030. As our new report shows, the road to future-proofing our global food system runs directly through APAC.