Three APAC countries with the right ingredients to dominate biomanufacturing

Global alternative protein stakeholders would be wise to keep a close eye on the bioeconomies of Thailand, Vietnam, and Australia, where analysts say abundant raw materials, forward-thinking public policies, or a synergy of both, have the potential to supercharge fermentation-derived food production.

That’s the key takeaway from a brand-new report titled Where to Build: Site selection and competitiveness in APAC fermentation manufacturing, commissioned by GFI APAC and conducted by Hawkwood Biotech.

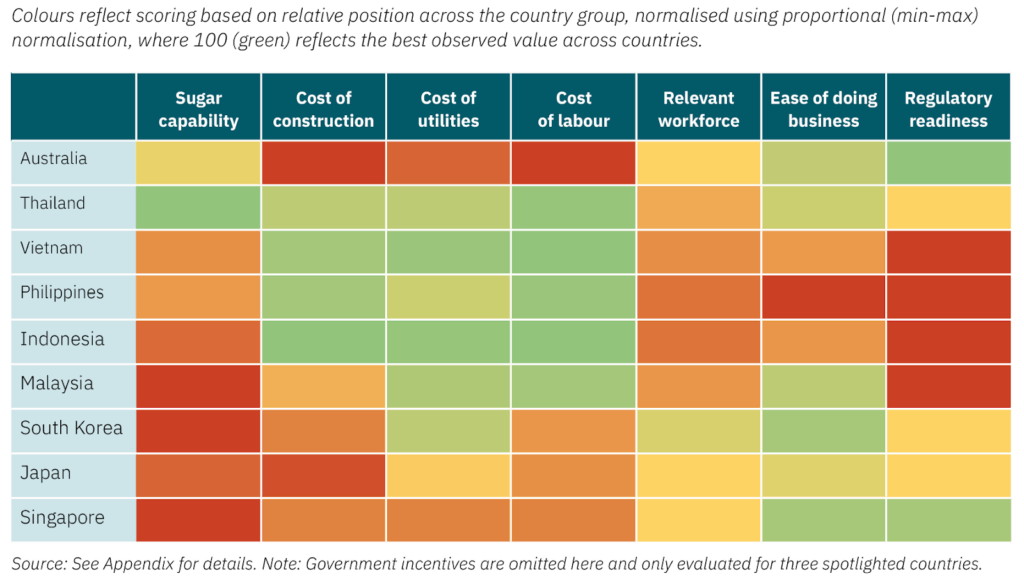

Drawing from executive interviews and technoeconomic modelling, the analysis identifies seven drivers of site selection for biomanufacturing for biomass and precision fermentation, such as feedstock costs, ease of doing business, and regulatory readiness.

Then, using a normalised competitiveness index, nine APAC countries were assessed across key site selection drivers. This index serves as a directional tool to highlight markets with promising cost structures and enabling environments for the manufacturing of fermentation-derived food ingredients.

What did the findings reveal?

Based on their relative strength on one or more key drivers of site selection, Thailand, Australia, and Vietnam were selected for deeper evaluation. For these countries, an additional layer of analysis was added to assess the role of government incentives, which can significantly influence site selection decision-making.

Incentives function as force multipliers that can either strengthen existing advantages or help to offset structural weaknesses. Indeed, of all the criteria assessed, government incentives and feedstock costs emerged as the two most critical drivers of site selection.

Interestingly, the analysis showed that some of the most high-impact incentives governments could offer differed from those industry leaders mentioned as influential to site selection in interviews. In other words, there may be more impactful incentives that fermentation companies could request to best accelerate domestic biomanufacturing progress.

Quantitative analysis of the impact of a range of incentive types on a biomanufacturing facility found that non-dilutive capital support (e.g., capital expenditure grants, loans, or guarantees) delivered the highest Return on Investment (ROI) for companies, as measured by projected net present value (NPV).

Non-dilutive CAPEX support also outperformed all other incentives in delivering the highest ROI for governments (as measured by projected tax revenue), creating a quintessential win-win. By comparison, tax holidays—the most-mentioned incentive in executive interviews—increase company returns, but often yield negative ROI for governments over the short to medium term. Similarly, feedstock subsidies have a high cost for governments, but deliver the same ROI as less costly interventions. By strategically selecting and structuring incentives to deliver mutual benefits to both sides, policies can more effectively accelerate scale-up and enable competitive production costs.

What could help top countries seal the deal?

🇹🇭 Thailand has one of the strongest feedstock positions in APAC and a relatively balanced profile across the various competitiveness indicators. Critically, Thailand stands out for its generous government incentives, and offers many of the top-ranked incentives that were identified in GFI’s analysis. However, its potential as a biomanufacturing location is diluted by uncertainty in the regulatory environment.

🇻🇳 Vietnam also boasts government incentives and a bioeconomy strategy, which signal strong intent to establish the country as an emerging biomanufacturing location. However, clear follow-through will be essential to compensate for Vietnam’s feedstock limitations and regulatory immaturity.

🇦🇺 Australia is a leader in the region on regulatory clarity and feedstock potential. However, it is a comparatively high cost environment, and a lack of coordinated federal government incentive support to offset these high costs leaves its advantages underleveraged.

“Clean energy companies travel the world to find the right combination of rare-earth metals and strategic partners who can harness their potential. In the same way, ‘future food’ production requires an abundance of highly specific raw ingredients and the political wisdom to unlock them,” says Tony Day, a partner at Hawkwood Biotech. “ClimateWorks Foundation estimates that by 2050, alternative proteins produced through fermentation and other innovative methods could generate up to US$700 billion annually in economic growth—but where those gains will go is still up for grabs. Of the countries reviewed in this report, few are better positioned than Thailand, Australia, and Vietnam. The pressure is on for local leaders to seize this opportunity before others do.”

What about everywhere else?

According to the study’s authors, countries of all shapes and sizes can still take clear steps to better position themselves as attractive sites for fermentation-derived food ingredient manufacturing:

1) Prioritise non-dilutive capital support

CAPEX remains the largest barrier to scaling new fermentation infrastructure. Tools that reduce upfront CAPEX, such as grants, guarantees, and concessional loans deliver the highest ROI for both governments and companies. Strategic investment in shared infrastructure, including pilot facilities and co-manufacturing hubs, can further lower investment barriers.

2) Establish clear and consistent regulatory pathways

Unclear regulatory requirements increase investor risk and delay commercialisation. Governments should establish clear approval pathways for fermentation-derived food ingredients, with clear timelines and guidance for safety, labelling, and novel ingredient approvals.

3) Support infrastructure and co-location strategies

Feedstock costs are the single largest operating expense for most industrial fermentation platforms. Governments can improve cost structures by enabling co-location with sugar processing facilities, and investing in fermentation-ready industrial clusters.

4) Create a national bioeconomy strategy with coordinated implementation

Disjointed policies and unclear institutional mandates reduce the effectiveness of national bioeconomy efforts. Countries that adopt integrated strategies—anchored by clear implementation mechanisms such as inter-ministerial taskforces, lead agencies, or dedicated funds—will be better positioned to align investment attraction, regulatory approvals, and commercialisation efforts. Private-sector stakeholders can catalyse such realignments by clearly articulating the distinct value proposition of food biomanufacturing to government stakeholders and pointing to and building on analyses like this new study as an indicator of untapped economic opportunities.

Ready to take a deeper dive?

- RSVP for our free one-hour webinar to receive country-specific insights on how governments and food companies can capitalise on APAC’s forthcoming biomanufacturing boom.

- Register for time slot 1 – 22 Oct, 9:00 AM SGT (GMT +8)

- Register for time slot 2 – 22 Oct, 11:00 AM ET / 5:00 PM CEST / 3:00 PM GMT

- Download the full report

Onwards,

Ryan Huling

Senior Writer | GFI APAC

Haven’t subscribed yet? Join our mailing list below to be the first to hear about updates like this!