Global patent data reveals China’s years-long commitment to scaling up cultivated meat

Earlier this year, China reaffirmed protein diversification as a central tenet of its national food strategy through a series of official policy announcements and public calls from lawmakers for “in-depth exploration, nutritional evaluation, and industrial production of alternative proteins.”

Now, analysis by GFI has shined the spotlight on another indicator of China’s long-term commitment to food security: its assertive pursuit of global cultivated meat patents.

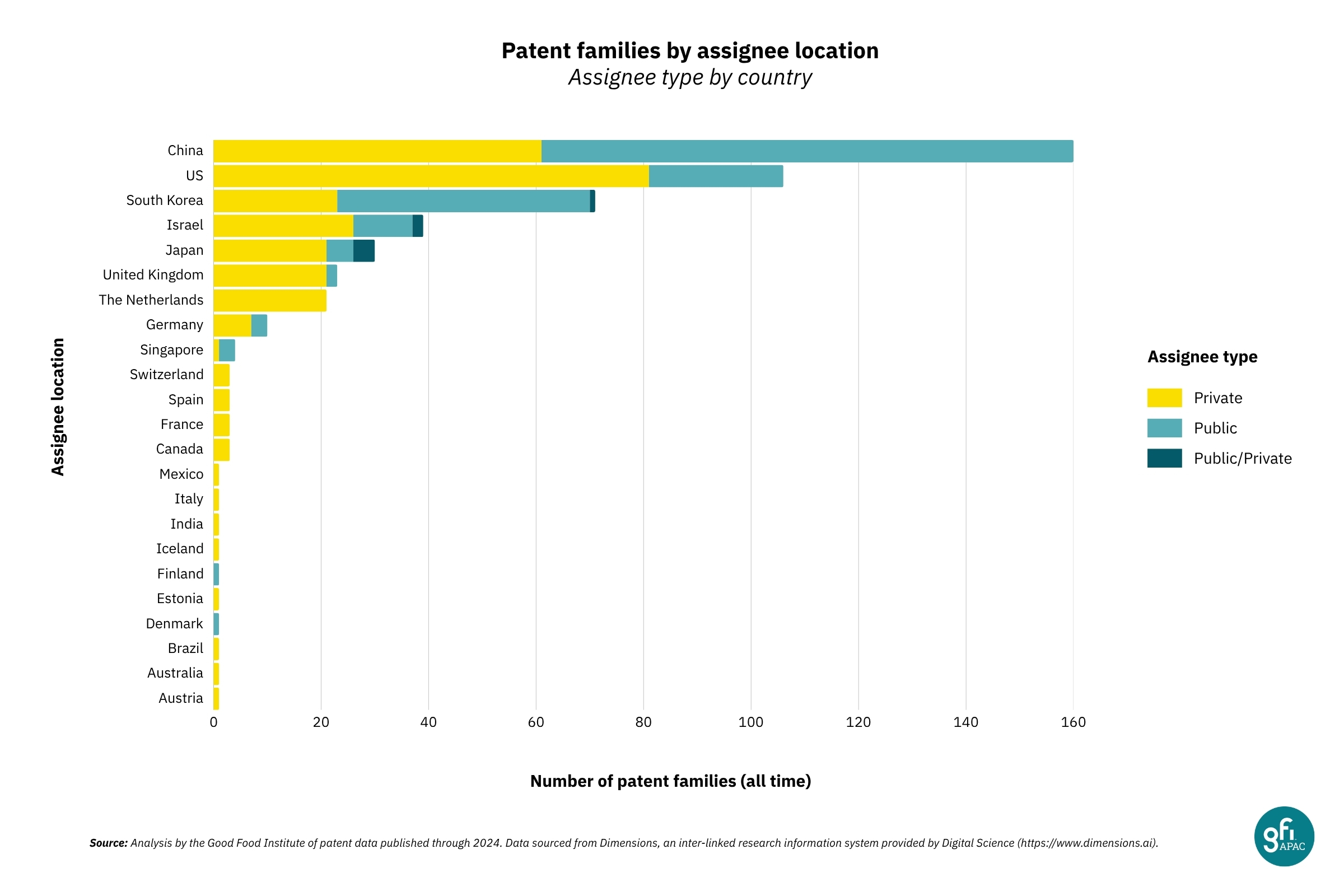

Of the Top 20 cultivated meat (CM) patent applicants of all-time, eight are in China, compared with only three from the US. Notably, China’s applicants also include multiple universities, which suggests very strong government interest and an intentionally collaborative approach designed to build out a national ecosystem. In fact, China’s universities/public institutions have filed more CM patents than their counterparts in the US and Europe combined.

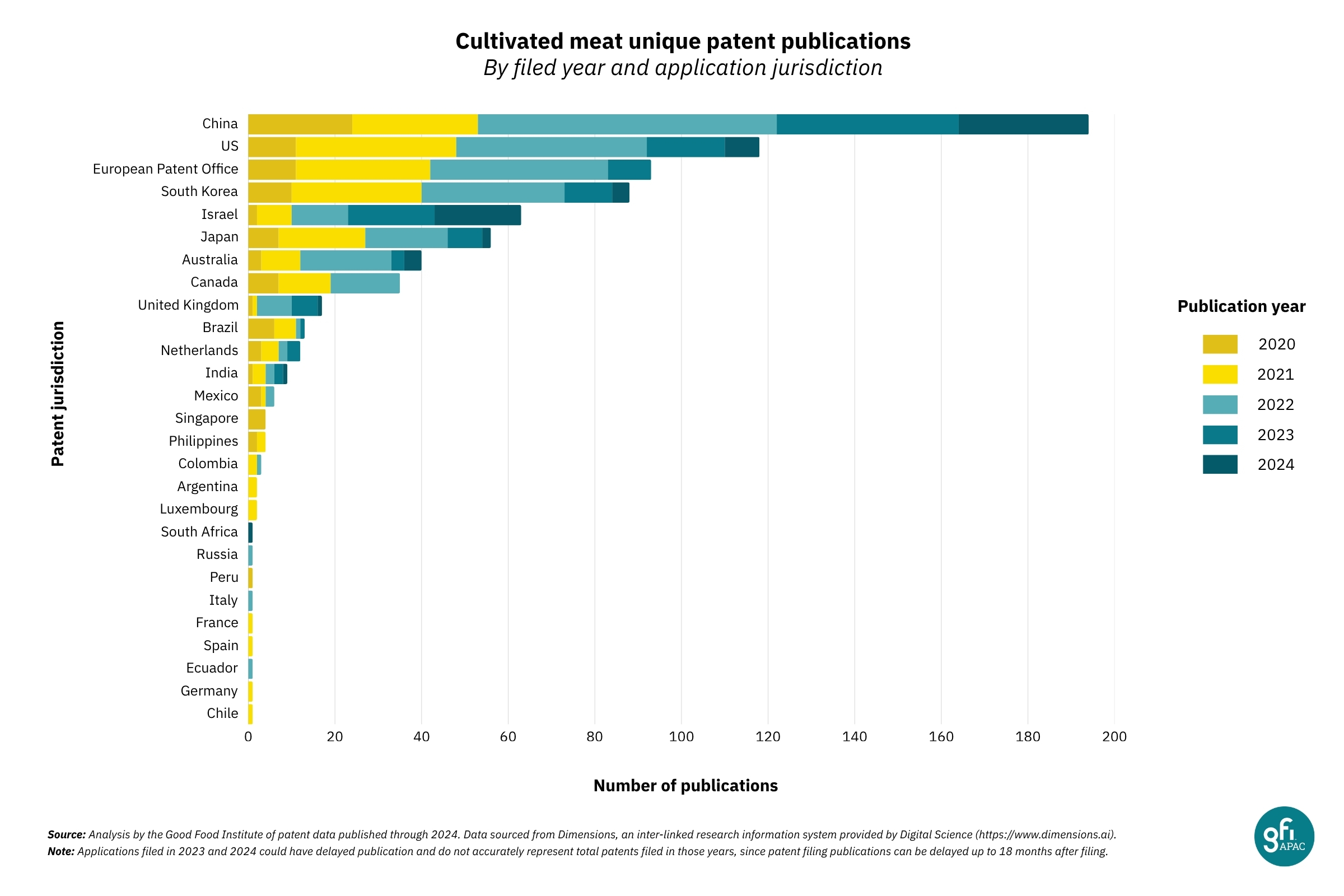

Similarly, more total CM patents have been filed in APAC than North America and Europe combined, with China serving as the top jurisdiction.

Which innovators made the Top 20?

Patent publications are measured by the total number of unique patent applications and patent families.* Chinese applicants are shown below in bold.

Patent families are arguably a more important figure here, because a patent family is a collection of patent filings that are related to the same invention, whereas unique patents include individual patents filed for the same invention in multiple jurisdictions. For that reason, patent families are a better indicator of where technical innovation is most wide-ranging and diverse, as a higher number of patent families indicates progress on a number of different scientific fronts.

- Upside Foods (US, private) – 143 / 43

- Aleph Farms (Israel, private) – 83 / 14

- Mosa Meat (The Netherlands, private) – 54 / 13

- Joes Future Food / Nanjing Zhouzi (China, private) – 30 / 25

- Believer Meats (Israel, private) – 28 / 5

- Yissum Research Development Company of the Hebrew University of Jerusalem (Israel, public) – 26 / 5

- Jiangnan University (China, public) – 22 / 16

- Avant Meats Co (China, private) – 22 / 4

- Zhejiang University (China, public) – 21 / 21

- Good Meat Inc (US, private) – 21 / 7

- Yonsei University (South Korea, public) – 19 / 14

- Tufts University (US, public) – 18 / 8

- China Meat Research Center (China, public) – 17 / 16

- Ocean University of China (China, public) – 15 / 12

- Ivy Farm (UK, private) – 15 / 10

- DaNAgreen Ltd (South Korea, private) – 14 / 6

- CJ CheilJedang Corp (South Korea, private) – 14 / 3

- SuperMeat (Israel, private) – 13 / 2

- Nanjing Agricultural University (China, public) – 13 / 11

- Shanghai Shiwei Biotechnology Co Ltd (China, private) – 12 / 11

* Caveat: Patent filing publications can be delayed for up to 18 months after filing, so some applications filed in 2023 and 2024 may not yet be published. We expect the totals for those years to continue to climb.

Collectively, the total number of patent families is significantly higher from China than the US or other markets. The fact that most of the active patent filers in China are assigned to public institutions—in comparison to the US’ majority-private-sector ownership—is also indicative of a broader national push to build a comprehensive innovation ecosystem around cellular agriculture.

The patents submitted by these entities cover a wide range of technological innovations, but all are related to the cultivation of animal cells for food/meat applications. Specific applications include cell line development, cell culture media development, cell scaffolding for creating particular meat products, or enabling technologies used to produce cultivated meat more efficiently.

Beijing spotlights cultivated meat in city-wide action plan

Capitalising on this momentum, the Beijing Municipal Commission of Development and Reform recently released a 2025-2027 joint action plan with the Pinggu District Government, marking the capital city’s first district-level special policy for advancing the green economy.

The plan specifically positions Beijing’s Pinggu district as a national leader and industrial cluster hub for alternative proteins, including cultivated meat. This marks the first time that China has released a government-issued action plan dedicated specifically to the alternative protein sector.

Cultivated fish maw bites, courtesy of China-based startup Avant

From China to the world

As Asia’s biggest economy and the world’s largest consumer of meat by a wide margin, China’s business and science ecosystem will be a critical driver of a regional shift towards sustainable proteins. Thankfully, the country’s top scientists have shown an eagerness to engage in international collaboration with their peers from Singapore, South Korea, Japan, Australia, and other APAC innovation hubs.

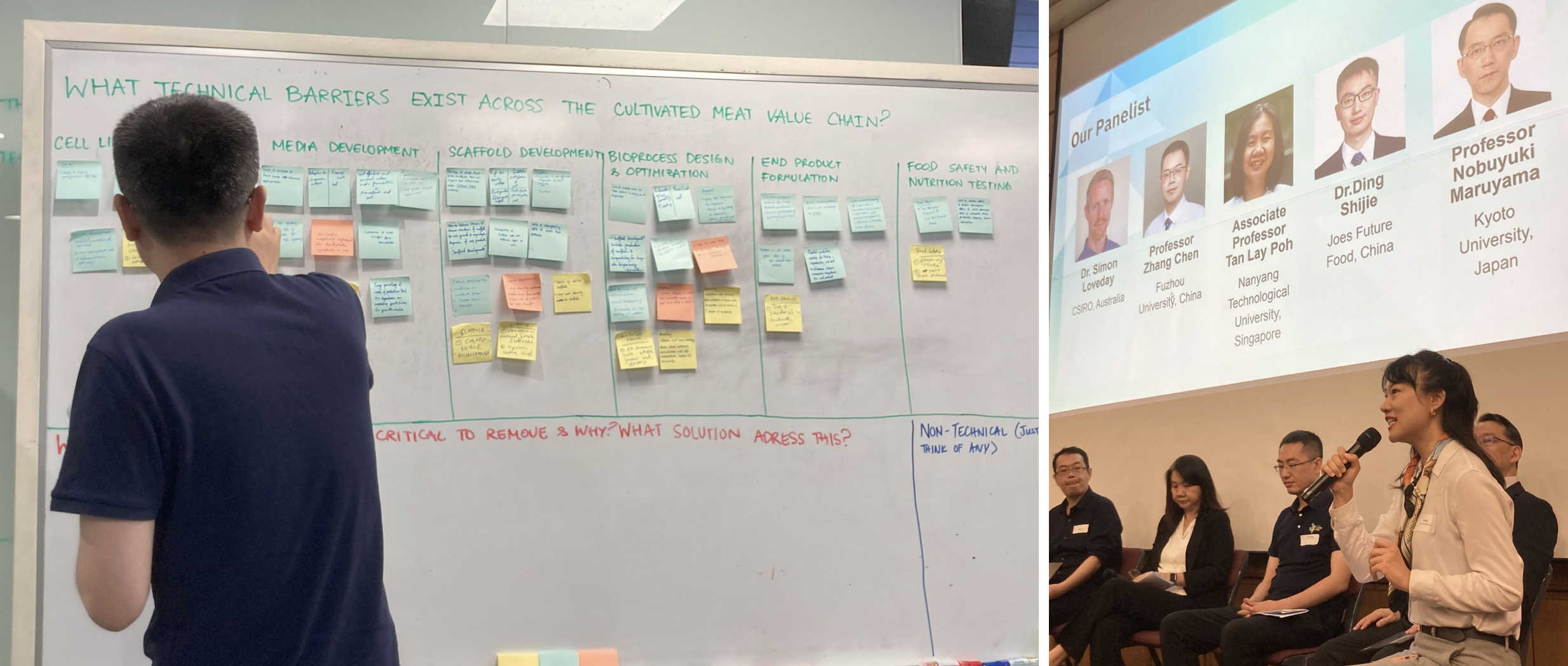

At the recent AltProtein Asia scientific symposium held at the Bezos Centre for Sustainable Protein in Singapore, Chinese researchers shared their latest findings and helped identify key bottlenecks to ramping up regional alternative protein development. At the event, attendees also recommitted to the central mission to resolve taste, scalability, and cost-competitiveness challenges for cultivated proteins—the biggest barriers to mainstream adoption.

Perhaps most importantly, China has also collaborated at a multilateral level to accelerate greater regulatory coordination by forming a new United Nations working group with their counterparts in Singapore, South Korea, and Saudi Arabia, focused on implementation of global guidelines for food safety assessments of cell culture media for cultivated meat production. Informed by open-access scientific data, these GFI-supported guidelines are designed to streamline regulatory review processes and create a glidepath to market for cultivated foods.

Viewed holistically, these simultaneous sprints suggest that China is strategically positioning itself as a locus of technological innovation, government-funded R&D, and policy leadership that can supercharge Asia’s ascendent ‘future foods’ industry. It remains to be seen whether the country’s political leaders will ultimately pull all of the policy and manufacturing levers at their disposal—but staking out a key role in the alt protein sector’s development all but guarantees that if cultivated meat becomes a globally traded commodity, China will join Singapore, South Korea, and other forward-thinking nations in reaping the rewards.

Onwards,

Ryan Huling

Senior Writer | GFI APAC

Haven’t subscribed yet? Join our mailing list to be the first to hear about updates like this!