BREAKING: Meat enhanced with plant proteins outperforms conventional version in A*STAR study

As GFI APAC wrote in the Straits Times earlier this year, one of the goals of integrating plant-based meat and other alternative proteins into the conventional meat supply is to deliver a product that can substantially reduce carbon emissions, mitigate supply chain risks, and deliver public and personal health benefits without compromising on taste. That last part is critical because the vast majority of consumers are not willing to sacrifice taste for the sake of increased sustainability or health.

To objectively measure whether or not the newest crop of products that combine animal meat and high-quality plant proteins were close to reaching taste parity with their conventional counterparts, GFI APAC partnered with NECTAR (an initiative of Food System Innovations) and commissioned A*STAR’s Singapore Institute of Food and Biotechnology Innovation (SIFBI) to conduct Asia’s first independent, large-scale blind taste test—a rigorous tool for assessing sensory performance.

Now, the results are in: Not only did several meats enhanced with plant proteins closely match their conventional counterparts on taste, but one even outperformed the original!

Wow! Which products performed best?

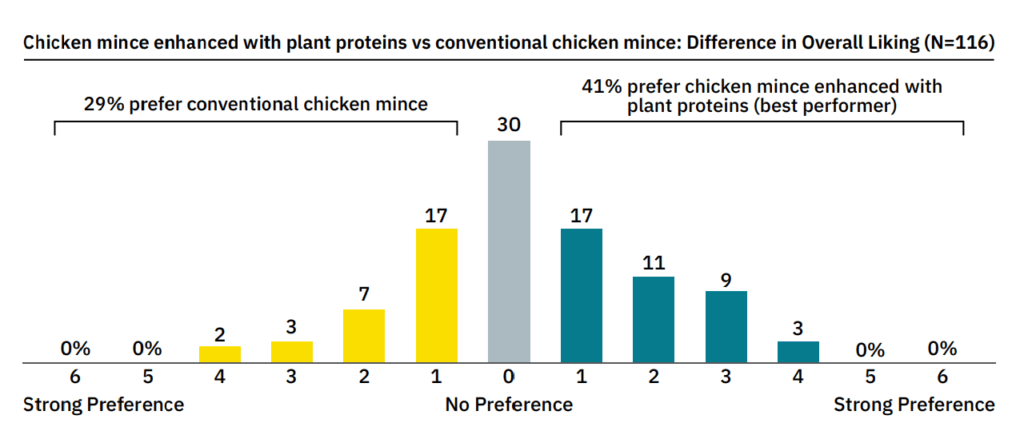

A chicken mince product created by Q Protein—a Singapore-based collaboration between local meat importer Quality Meat, CREMER Sustainable Foods, and Temasek subsidiary Nurasa—outperformed conventional chicken mince in blind tests, meaning that the healthier and more sustainable option also tasted better. Q Protein products just started to hit Singaporean grocery stores and those tested in the study were composed of between 30 – 50 percent plant proteins.

Several other products that combine animal + plant proteins were within striking distance of taste parity with their conventional meat counterparts, including chicken chunks and beef mince (both performed within 0.2 points of the fully animal version, on a 7-point scale). Meatballs, chicken tenders, and chicken patties that featured up to 50 percent plant proteins were also within 0.5 points.

The results are all the more impressive considering that this emerging category has yet to receive significant R&D funding, which can go a long way towards further improving product taste, price, and consumer acceptance. Additionally, some of the tested products were pre-commercial prototypes that are being continuously fine-tuned. In other words, these findings represent the floor for enhanced meat performance, not the ceiling.

“Our analysis shows that enhancing animal meat with high-quality plant proteins can boost taste and broaden its appeal among local consumers. The fact that at least one enhanced meat product already outperforms its conventional counterpart suggests this nascent category is building on a very strong foundation, and greater R&D investment could propel it to new heights.”

Prof. Jianshe Chen

Head of the Division of Food and Sensory Science

Singapore Institute of Food and Biotechnology Innovation (SIFBI), A*STAR

What should we call these products?

There is no universal consensus on nomenclature to describe products that combine high-quality plant-based proteins with conventional animal protein. Various terms—including “enhanced,” “balanced,” “hybrid,” and “blended”—have been used, but in most cases, companies operating in this category advertise their products, first and foremost, as meat.

Plant-protein enhancements, including flavour and nutrition upgrades, are often positioned as secondary benefits. “Beef + plant protein,” for example, would be preferable over “plant-rich beef,” which could be misinterpreted by shoppers as a fully plant-based product.

To help companies navigate this new category and speak effectively about it, GFI APAC collaborated with more than a dozen industry partners to develop a new Communications Guide, complete with FAQ responses and messaging recommendations.

Expanding the circle of alternative protein consumers

Among the most important takeaways from this new study is that enhancing meat with plant proteins reaches consumers that fully plant-based meats do not. According to SIFBI’s data, study participants were 40 percent more likely to show interest in purchasing products that combine plant and animal proteins than fully plant-based meat. Moreover, 50 percent of those who “would buy” or “definitely would buy” meats enhanced with plant proteins showed low intent to purchase fully plant-based meat, indicating the potential to unlock new consumer profiles.

This finding mirrors earlier research by GFI APAC in which more than three-quarters of Southeast Asian consumers who identified as sceptical of trying fully plant-based meat said they were interested in trying meats enhanced with plant proteins, including 80 percent of those who have eaten fully plant-based meat before but don’t intend to again.

“Integrating plant proteins with conventional meat has the potential to enhance product nutrition, boost protein content, lower prices, and increase food-industry profit margins,” says report co-author and GFI APAC Head of Corporate Engagement Jennifer Morton. “Such products could also create a virtuous cycle in which plant-protein producers can rapidly scale up their manufacturing capacity, leverage economies of scale, drive down costs, and expand the accessibility of sustainable proteins, including fully plant-based products.”

Onwards,

Ryan Huling

Senior Writer | GFI APAC

Haven’t subscribed yet? Join our mailing list below to be the first to hear about updates like this!